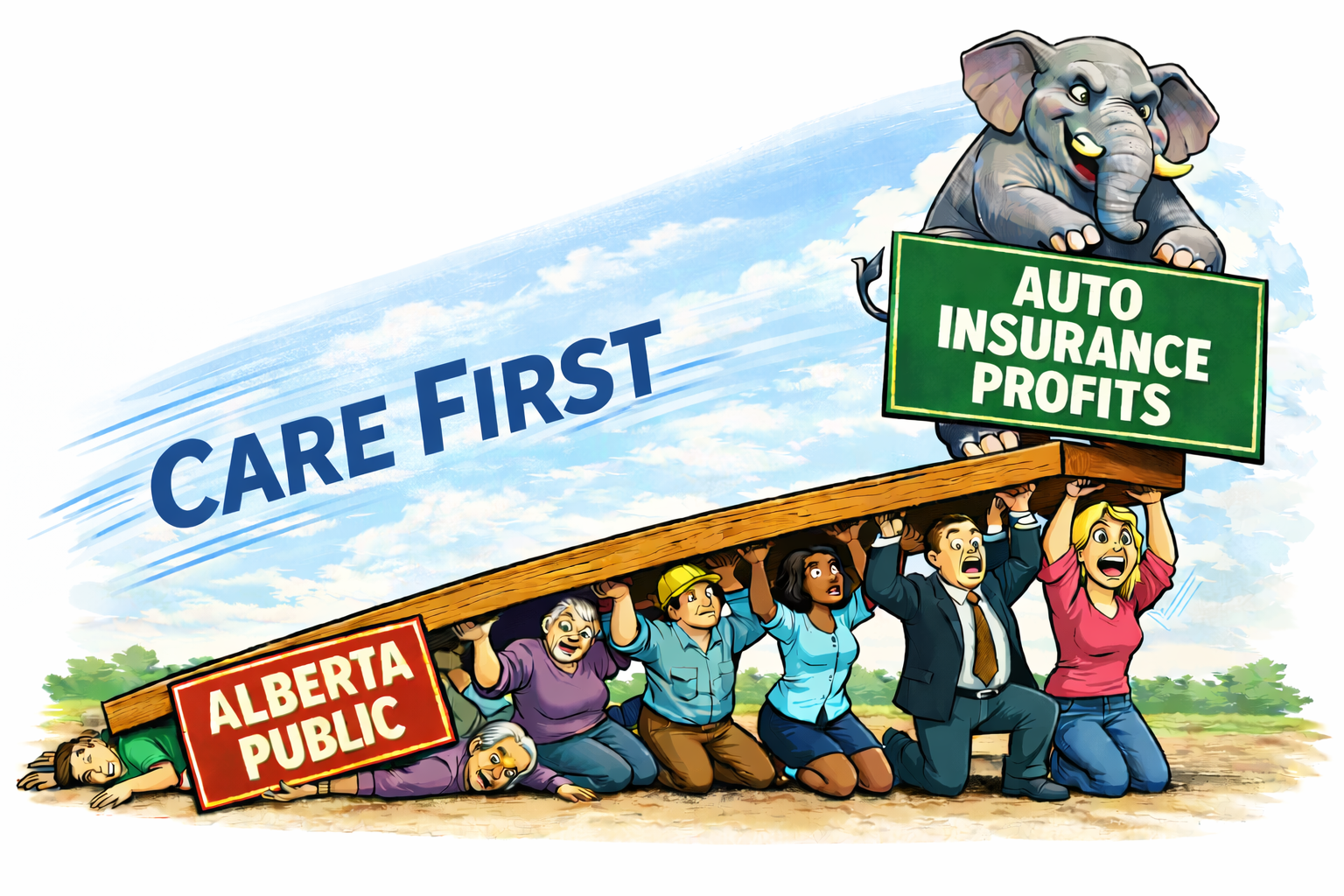

The following is an imaginary scenario in which an injury victim comes to my office after the Alberta No Fault (otherwise labelled “Care First”) Automobile Insurance Act comes into force in January 2027. The description of what would happen to that injury victim when No Fault Insurance comes into effect in Alberta is all too real.

The Accident and the Injury

It is a Tuesday afternoon, June 15, 2027. The man who has come to my office—let’s call him Mark—was driving his pickup truck on Highway 63, heading north to a new job site. Mark is 34 years old, an independent contractor working as a pipefitter in the oil industry. Prior to his accident, he was healthy, hardworking, and in the prime of his career.

A driver coming from a side road blew through a stop sign at high speed and T-boned Mark’s truck directly on the driver’s side. The impact was catastrophic. Emergency Medical Responders (EMRs) arrived quickly—the only reason Mark survived. They determined he had a fractured hip and pelvis, massive soft tissue injuries, and almost certainly severe nerve damage. He was bleeding out.

Mark was rushed to the hospital and taken straight into surgery. To save his life, the trauma team had to perform a hip disarticulation—they removed his entire left leg at the hip joint.

The Immediate Aftermath

In the few seconds it took for the collision to happen, Mark’s life had changed forever.

He tells me that when he woke up, the reality slowly settled in. He would require months of hospitalization, followed by grueling rehabilitation to learn how to use a new prosthetic leg. But the hardest realization was about his future. A pipefitter’s job requires climbing, lifting, and balancing. Mark’s career in the oil patch—the career he had built to support his family—was over.

Police investigation revealed the other driver was speeding, but the roads were icy, and his attempts to brake were not successful. He was also taken to hospital but had no serious injuries. By the time a breathalyzer test was given, he was just under the limit. No criminal charges were filed. Thanks to the new Care First Automobile Insurance, that driver walked away with a temporary license suspension and a fine.

Under the old system, Mark could have held him accountable. He was about to find out that under this new system, the other driver’s possible recklessness was irrelevant to Mark’s compensation.

The Insurance Settlement

Body Part / Function | Injury Description | Impairment Rating | Payout |

Lower Limb | Table 19: Hip disarticulation (entire leg removed at hip) | 45% Permanent Impairment | $85,074.75 |

Mark explains that, with help from his sister, he filed a claim with his insurance company. He assumed that because he was the innocent victim of a drunk driver, and because his injury was so severe, he would be taken care of.

He found out he was wrong. His claim was processed under Alberta’s “Care First” No-Fault Insurance system (this is the legislation that is to come into effect in January 2027).

I explain that the insurance company didn’t look at Mark’s lost career potential or his pain. The company simply referred to government-regulated schedule of payments—what consumer advocates call the “Meat Chart”—to discover the required payout.

Here is the actual breakdown that the insurance company would see (based on the Alberta government’s current plans for Care First).

Mark was a “Hip disarticulation (entire leg removed at hip)”—hence, the name “Meat Chart”.

Mark shows me the cheque he had received: $85,074.75.

That was the price Care First put on his leg and his livelihood. It wasn’t even enough to cover one year of lost wages, let alone a lifetime disability.

That’s why Mark had come to me looking for help. He told me, “I’m not accepting this. I want to sue.”

Fighting No Fault Insurance in Alberta

Hiring an Injury Lawyer

Mark sits across from me, desperate for help, and I have to explain to him that the rules have changed. This is the hardest part of my job now.

“I believe you, Mark,” I say. “Under the old system, you could’ve sued. But I can’t take your case to court. In fact, you can’t sue the other driver at all.”

I explain that under the Care First model, the government removed the right to sue negligent drivers. I tell him that it doesn’t matter that the other guy was probably drunk. It doesn’t matter that Mark lost his career. The courts are closed to Mark.

“But I need a lawyer,” he says. “You can help me fight the insurance company, right?”

I shake my head, no.

Mark is stunned. He realizes he is trapped. The system is designed to stop him from getting legal help.

Appealing Your Insurance Settlement: The Alberta Care-First Tribunal

“There has to be someone I can talk to,” Mark persists. “Who oversees this?”

“There is one option,” I tell him. “It’s called the Automobile Care-First Tribunal.”

I explain that this is a new dispute body created specifically for such cases. But I have to warn him: it is not a court of law.

- Who runs it? It is funded by the insurance industry—the very people Mark is fighting against.

- The Power Dynamic: The Tribunal decides if the insurance adjuster made a mistake on the chart. They don’t look at “fairness” or “justice.” They just check if the math was done correctly according to the regulations.

- You Pay Lawyers: The system is built so you have to argue it yourself . You are an injured pipefitter going up against professionals who work for the insurance company. I explain to Mark, “if you’re wealthy enough, you may be able to afford the injury lawyer’s fees and pay for it all yourself in the hope that you’ll win. But for ordinary Albertans, forget it.”

Mark says, “BC has no fault insurance. Is this what they do in BC?”

“Not exactly,” I answer. “BC has no-fault insurance too, but their tribunal is completely different. Care First is set up to favour insurance companies.”

I pull out a sheet to show him the difference. (The following table is based on the Alberta government’s current plans for Care First and assumes no significant changes are made by law or regulation.)

Comparison: Alberta Care-First Tribunal vs. BC Civil Resolution Tribunal

| Feature | Alberta Automobile Care-First Tribunal | British Columbia Civil Resolution Tribunal (CRT) |

| Status | Proposed/Legislated Effective Jan 1, 2027, under Bill 47. | Active Established 2012; assumed jurisdiction over vehicle injuries in 2019/2021. |

| Funding | Industry-Funded The tribunal is paid for by a levy on private insurance companies. | Publicly Funded It is part of the public justice system, funded by the Ministry of Attorney General. |

| Member Selection | Government Appointed Members are appointed by the Minister. Critics note the lack of a defined independent merit-board process. | Merit-Based Appointment Members are appointed by the Lieutenant Governor in Council after a formal screening process. |

| Role of Lawyers | Heavily Restricted (Financial) The tribunal cannot award legal costs. This means victims must pay lawyers out of their own pocket. | Permitted but Limited You generally do not need permission to hire a lawyer, though cost recovery is rare. |

| Independence | Controversial Critics argue that being funded by the private insurers it regulates creates a conflict of interest. | Independent It is a public body independent of ICBC (the Crown insurer). |

| Jurisdiction | Auto Insurance Only Exclusively handles disputes regarding bodily injury and benefits. | Broad Handles auto insurance, condo disputes, and small claims. |

| Decisions | Final No appeal | Broad Subject to court review in certain circumstances (judicial review / statutory pathways) |

Another Victim of “Care First” No Fault Insurance in Alberta

Mark looks at the chart, then at his prosthetic leg, and finally at me. He realizes that the system isn’t broken; it was built this way on purpose.

“To favour insurance companies–now I get it. So, the guy who hit me is driving again,” Mark says quietly. “And I’m left with $85,000 and an artificial leg.”

“I’ll try writing my MLA,” he says, “but I don’t expect they’re listening.”

He leaves, and I look at his file on my desk—another case I can’t help, another victim of “Care First.”

Conclusion

The entire point of this fictional account is that all too soon, Care First will not be fiction for Albertans injured in motor vehicle accidents. But it is not too late to do something about it.

- Talk with your friends and neighbours and let them know how you feel.

- Phone or email your local MLA and tell them you are against no-fault insurance.

- Phone or email the Premier.

- Sign the Albertans against No-Fault Insurance petition on Change.org

- On Facebook, follow FAIR Alberta, a coalition of concerned consumers, medical professionals, lawyers, and other Albertans that is opposed to Alberta’s move to no-fault insurance.

- You may want to consider a donation to the Alberta Civil Trial Lawyers Association or AANFI to assist in this fight.

Let the Alberta Government know you refuse to let insurance companies have all the power.

Sources

- FAIR Alberta (Meat Charts & Legal Rights):

- Legislation & Government:

- Media & Analysis:

- Consumer Advocacy: