Introduction

What the Alberta UCP Government tells us about its new no fault auto insurance scheme, and what it will actually mean for Albertans are very different. Albertans have seen the tragedies in other jurisdictions, like British Columbia, where no-fault auto insurance has been implemented. Albertans do not want this system. A recent poll showed that 68% of Albertans want the UCP Government to explore options for lowering premiums within the at-fault system, compared to 16% who wanted the government to explore the no-fault system. Nonetheless the UCP Government is moving forward with no fault insurance, which is to come into effect on January 1, 2027. What will no fault auto insurance mean for Albertans?

It Is Not a Care First Model – It Is a No-Fault Model.

No fault auto insurance means no injury lawyers – and no accountability. The Alberta UCP Government calls no fault insurance a “care first” model. Their idea is that banning lawyers saves on legal costs, which are passed on to the consumer. Their idea is also that more care will be provided by insurance companies to injured victims so that they will not need the right to sue. Everybody is happy, right? But what is the reality awaiting Albertans?

There is no guarantee of accountability under the Alberta UCP Government’s no fault auto insurance. Injury lawyers protect claimants and hold insurance companies accountable, but no-fault insurance removes injury lawyers from the process. I am commonly asked by people: “I have insurance. Do I even need an injury lawyer?” My answer is: “If the insurance company treated you fairly, I would not have a job.”

No fault auto insurance means there is no certainty that injury victims will receive the care the insurance companies are mandated to provide. In short, the fox is being entrusted with guarding the henhouse.

The Fallacy of “Measurable Benefit”

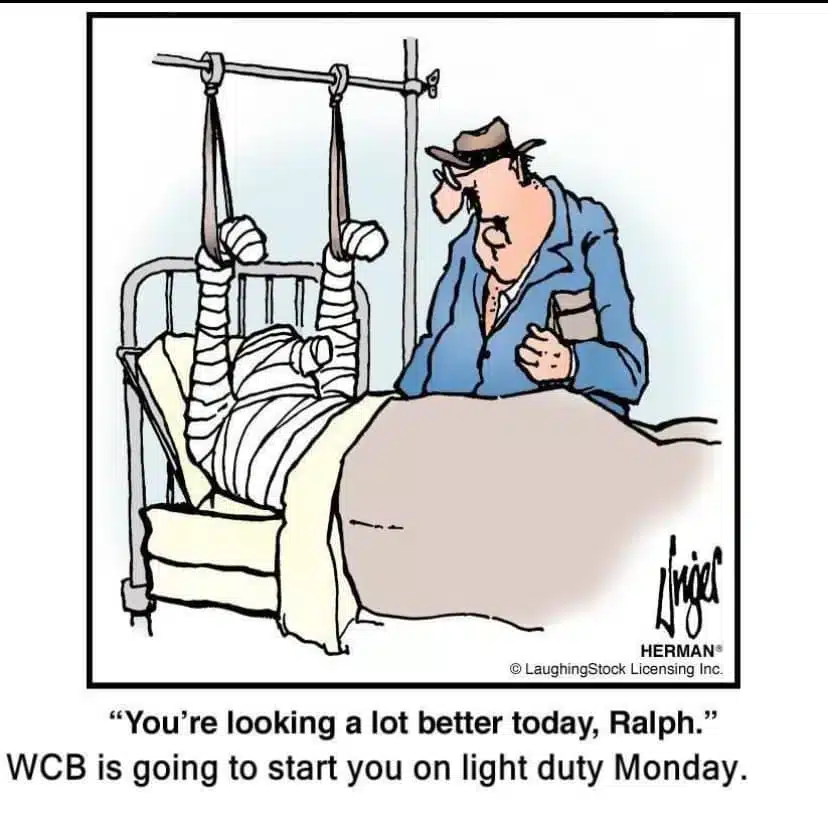

The Alberta UCP Government’s proposed no-fault auto insurance system provides care to injury victims as long as there is a “measurable benefit.” Who determines whether there is measurable benefit? Insurance companies will have unfettered discretion as to what this means. If you are familiar with the WCB system of care, you will understand what this will mean for the injury victims of auto accidents.

Under no fault auto insurance, the injury victims will have to challenge the insurance company’s decisions at their own expense at a time when they can least afford the cost due to the nature of their injuries. Injury lawyers, who pay at their own risk for medical experts to prove claimant damages, are removed from the system. Conversely, the well-funded insurance companies can hire physicians as paid advocates to come to a determination on what a measurable benefit is.

The Fallacy of Litigation Costs Adding to Insurance Costs

Why is this a fallacy? The legal fees paid to an injury lawyer come from the injury victim’s settlement. The insurance company does not directly pay the lawyer’s fees. In fact, if insurers treated people fairly, there would be no legal fees and as mentioned, I would not have a job. What does add to insurance costs? Insurers often fail to mention their own exorbitant costs defending injury claims to reduce the compensation they would otherwise have to pay to the injury victim. In fact, very few injury claims are fraudulent.

The fair solution is not to take away people’s right to sue if they are the injury victims of auto accidents. And it is certainly not to eliminate lawyers from the picture. The solution is to pay people what they are properly owed in the first place. That isn’t the case with the Alberta legislation; instead, injury victims are being denied the right to sue for fair compensation.

The Fallacy of Being Able to Sue in Select Cases

The Alberta UCP Government states that at-fault drivers can be sued for pain and suffering damages if they are convicted of a criminal offence, such as impaired driving or dangerous driving, or for certain offenses under the Traffic Safety Act. What will suing an at-fault driver mean in practice?

- It is practically impossible and tremendously unrealistic and misleading to suggest that you can sue for anything more than general damages (pain and suffering).

- Additionally, if the defendant is uninsured, you will have to pursue a defendant with no assets.

- Finally, the Crown generally “pleads down” these offenses to less serious ones, effectively disqualifying these cases from the realm of cases where you can sue.

How You Can Help

The UCP Government allows Alberta auto insurance companies to raise their rates as much as 7.5% each year until the new no-fault legislation comes into effect on January 1, 2027. If you don’t want a no fault auto insurance system that benefits the insurance companies at the expense of injury victims, I urge you to write or e-mail your MLA voicing your concerns. To get started, just go to Who’s My MLA – Search | Elections Alberta and tap in your address to find your MLA.

Until then, you can

- sign the Albertans against No-Fault Insurance petition on Change.org

- follow me on LinkedIn or Facebook or follow Fair Alberta for up-to-date information on the fight to stop no-fault insurance in Alberta.

You may want to consider a donation to the Alberta Civil Trial Lawyers Association to assist in this fight.

To learn more about the negative impacts of British Columbia’s no fault insurance visit the No to No Fault website.

If you have suffered a personal injury and need the expertise of a proven, experienced lawyer, call (780) 760-4878 (HURT) or contact me personally, Joseph A. Nagy. We can discuss the issues related to your claim, and I will explain how I can help you. You will be under no obligation to hire me as your lawyer.

Also See...

Dangerous New No-fault Auto Insurance Scheme Proposed for Alberta: Update

Introduction What the Alberta UCP Government tells us about its new no fault auto insurance scheme, and what it will actually mean for Albertans are

What Is No-Fault Insurance?

Joseph A. Nagy Injury Law opposes the introduction of any further cap, thresholds, deductible, or no-fault measures that will eliminate the rights of Albertans to obtain FAIR compensation for their injuries. Learn more…